Table of Contents

ToggleClosing the Year with Confidence: Your Holiday Escrow Checklist

The end of the year is a busy time in real estate, making escrow very important. With holiday schedules and deadlines piling up, mastering the escrow process is key to ensuring smooth year-end closings. Banks have shorter hours, vendors take time off, and buyers and sellers have their own holiday commitments. If your escrow isn’t managed well, a standard transaction can become stressful.

Having a clear holiday escrow checklist keeps everything organized. It helps you manage expectations, avoid delays, and ensure that all requirements are met before the new year. At New Era Escrow, we aim to simplify the real estate process so our clients can move forward confidently.

Why Year-End Closings Need Extra Attention in Escrow

Year-end closings can be complicated, and escrow officers are crucial in keeping everything on track during the holidays. Bank, lender, title company, and county office closures can cause delays.

Banks have shorter hours during the holidays. If you send a wire transfer after the cutoff time, it won’t process until the next business day, which can push closing into the new year. Lenders also have higher workloads and fewer staff, which can even slow down simple requests. Title companies may have smaller teams, which can delay title clearance. County recorder offices might stop accepting recordings early in the last week of December, delaying ownership transfer until after the holidays.

These challenges are common during year-end closings, making early planning and careful timeline management essential (Younger, n.d.).

Common Holiday Escrow Challenges and How to Avoid Them

Holiday-season closings come with predictable obstacles, and escrow is the front line in preventing them:

Delayed inspections and appraisals

Solution: Escrow coordinates with agents early and sets expectations for availability.Last-minute loan issues

Solution: Escrow maintains constant communication with the lender and proactively reviews loan conditions.Wire transfer delays

Solution: Escrow encourages early fund deposits and warns clients of bank schedules.Document errors or missing signatures

Solution: Escrow reviews documents well in advance and secures signing appointments early.

A well-managed seasonal escrow anticipates these challenges. From large contract details to the smallest initials on a form, an escrow officer’s careful attention ensures the transaction stays on track (Younger, n.d.).

Essential Steps for a Smooth Real Estate Closing Through Escrow

1. Review All Escrow and Transaction Documents

A complete file is necessary for a successful closing. Your escrow officer should check that:

- Purchase agreements match all changes.

- Inspection and repair reports are submitted.

- Loan documents are ordered and scheduled.

- Vesting information is accurate.

Missing documents can delay signing or funding, especially during the holidays.

2. Communicate With All Parties Early and Often

Stay in touch with buyers, sellers, agents, lenders, title companies, HOA representatives, and insurance providers. During the holiday season, clear communication helps avoid delays.

3. Verify Financials and Escrow Funds

Financial cutoffs can cause issues. Banks may stop processing wires, and lenders may pause funding. Escrow officers should:

- Confirm wire instructions early.

- Ensure funds are deposited before closures.

- Coordinate with lenders in advance.

4. Schedule Signings and Key Dates Around Holiday Closures

Plan signings early to allow time for document review. This ensures:

- Mobile notary appointments are set.

- Signings occur before office closures.

- Funding and recording dates align with county schedules.

This is where a well-managed seasonal escrow shines—timing is coordinated from start to finish, so nothing slips through the cracks.

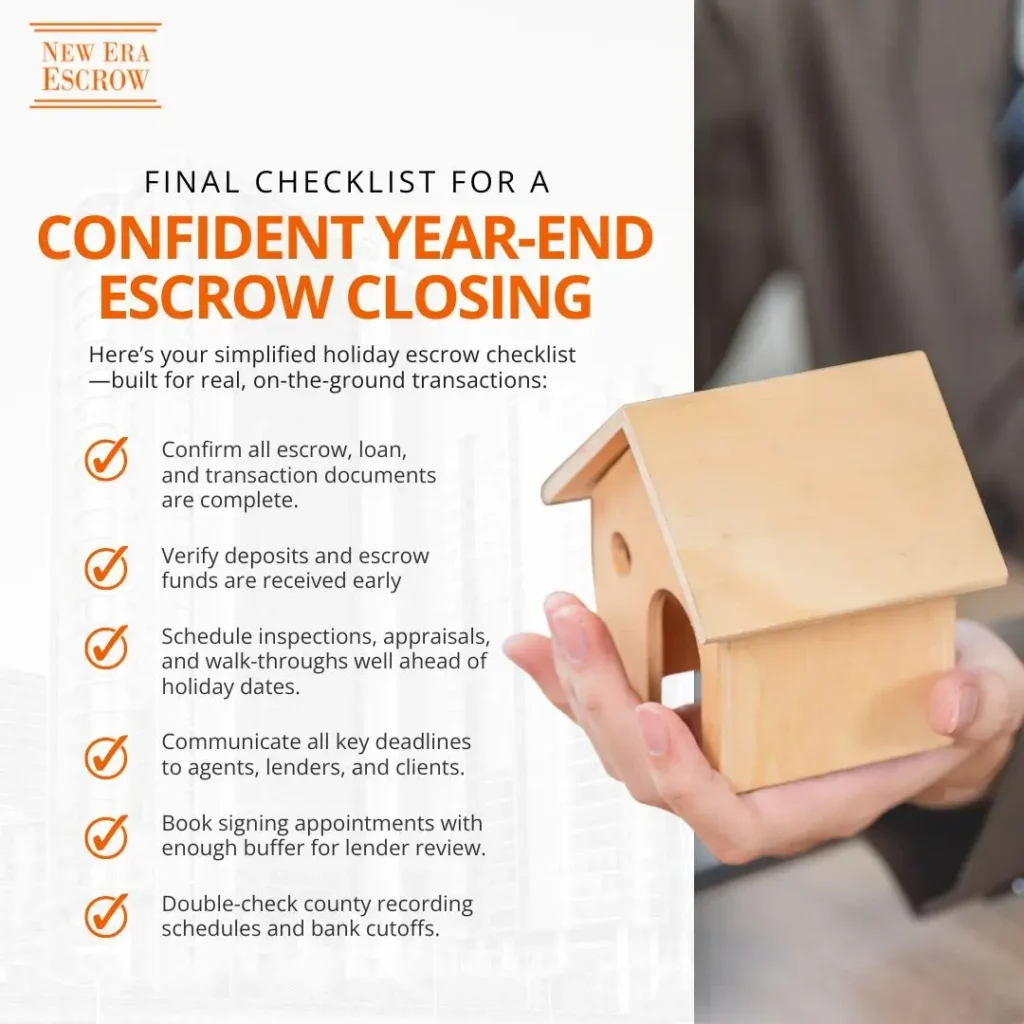

Final Checklist for a Confident Year-End Escrow Closing

These steps ensure your real estate closing runs smoothly, even during the seasonal rush.

Escrow is the backbone of every successful year-end closing—and the holiday season magnifies the importance of a detail-driven process. With the right planning, communication, and coordination, a seasonal escrow can move efficiently from opening to recording without the holiday stress.

Simplify your real estate transactions with New Era Escrow. We deliver transparent, reliable services you can count on at every step. With a process built on precision, transparency, and unwavering commitment, we streamline every detail of the real estate closing. Whether you’re wrapping up a year-end transaction or preparing for a fresh start, our team ensures you move forward with confidence and step into the next chapter on solid ground.

Connect with New Era Escrow today and let us guide you through a seamless, stress-free transaction.

Key Takeaways

- Year-end closings are prone to delays from bank, lender, title, and county office closures. Early document review, clear timelines, and proactive coordination with all parties are essential to keep transactions on track.

- A well-managed seasonal escrow handles document accuracy, fund verification, and scheduling around holiday closures, preventing common issues like delayed inspections, wire transfers, or missing signatures.

- Partnering with a reliable escrow provider like New Era Escrow ensures a precise, stress-free closing process. Clients can confidently finish the year strong and enter the new year with their real estate goals achieved.

References

Redfin. (2022, February 22). Close of escrow: What it means in real estate. https://www.redfin.com/blog/close-of-escrow/

Younger, S. (n.d.). What is escrow? A clear guide to the escrow process in Los Angeles real estate. https://stephanieyounger.com/what-is-escrow-a-clear-guide-to-the-escrow-process-in-los-angeles-real-estate/

Share this article in :