Table of Contents

ToggleHow long does it take to complete an escrow account?

Escrow services are becoming more popular yearly to streamline the process of real estate transactions. Aside from knowing the beneficial services it offers, another vital question is, how long does it take to complete an escrow account? If you are looking for answers regarding the escrow process and the time it takes to complete an escrow account, you are in the right place! Continue reading to find out how you can make your escrow process swiftly.

HOW LONG DOES IT TAKE TO COMPLETE AN ESCROW ACCOUNT?

The escrow process or account is one of the essential tools you should use to protect your business. It allows you to safely hold and store your funds until it’s time to disburse them, which helps prevent the risk of someone stealing your cash. Many people ask how long it takes to complete an escrow account. Everyone wants to know the time it will take to complete a sale when selling real estate, similar to escrow accounts. People want to know how long the process takes to complete an escrow account.

In most cases, the escrow process takes an average of 30 days. Still, this number can vary depending on the agreement between both parties, the escrow company and officer, and others. Though, preferably, the escrow process should not exceed 30 days. The escrow process is relatively straightforward. It is not as time-consuming as a traditional loan transaction. The escrow account officer will need to review documents that follow the terms of the real estate sale agreement. Collect applicable liens and fee information, send out a title report if required, and then make all closing documents available to all parties to close the escrow account.

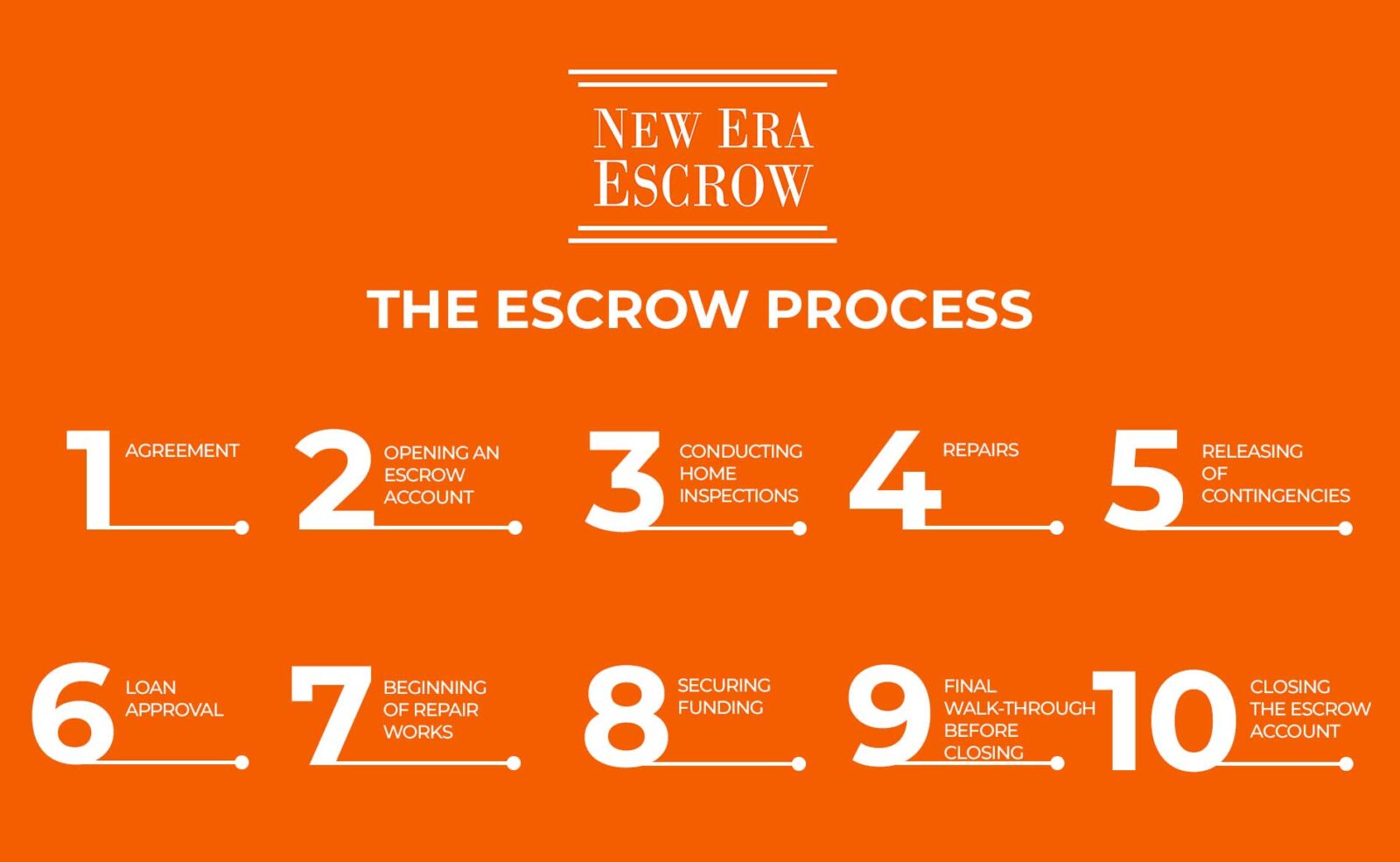

HOW TO PROCESS AN ESCROW ACCOUNT IN 30 DAYS?

Disclaimer: The process is just a pattern of how the 30-day process takes place but can also be applied when securing an escrow account.

Step 1: AGREEMENT

Both parties, the buyer and seller, should agree on the selling price. The said agreement is the start of the closing process.

Step 2: OPENING AN ESCROW ACCOUNT

The buyer should deposit the earnest money into the new escrow account.

Step 3: CONDUCTING HOME INSPECTIONS

The inspection phase will take place, which includes house inspection, lender appraisal, Agent Visual Inspection Disclosure (AVID), and termite inspection. Findings may affect the negotiation.

Step 4: REPAIRS

The results of the inspection will affect the negotiation and requests for repairs.

Step 5: RELEASING OF CONTINGENCIES

Releasing contingencies includes signing contract papers.

Step 6: LOAN APPROVAL

The approval of the loan must be taken care of by the buyer from the lender appraisal to guarantee funds for closing.

Step 7: BEGINNING OF REPAIR WORKS

The house seller must finish all repair works and ensure that the house is in good condition, in the state agreed upon by both parties.

Step 8: SECURING FUNDING

The buyer can secure the funds for purchase when the appraisal is complete.

Step 9: FINAL WALK-THROUGH BEFORE CLOSING

The buyer can have a walk-through days before the closing of the sale.

Step 10: CLOSING THE ESCROW ACCOUNT

After several processes, the buyer will acquire the real estate title, including the house’s keys. On the other hand, the seller will receive the payment for the sale.

The escrow process can be pretty daunting, given it involves complex financial transactions and paperwork. Especially if you’re a first-time buyer trying to get an idea of how long it takes to complete an escrow account. But knowing the process and the benefits of escrow will make your real estate transactions faster and much more secure.

To know more about the New Era Escrow process, you can visit our website, send us a message and our escrow officer at New Era Escrow will manage all aspects of the escrow process from start to finish.

Troy Segal. (2022, June 13). Understanding the Escrow Process and Requirements. Investopedia.

James Chen. (2021, March 25). In Escrow Status. Investopedia.