Table of Contents

Toggle7 Things You Need to Know About Escrow

One of the most common terms you’ll hear in real estate and mortgages is “escrow.” It is a lengthy process that begins when the buyer and the seller agree on a price to the time the key is handed over to the new homeowner. Some may think that this period is dedicated to doing nothing but waiting for the turnover to occur.

Wrong.

Once a deal is made between the two parties, an account is opened for deposits and payments.

Once this is taken care of, the buyer’s waiting period for a couple of things begins at:

- Bank approval.

- Getting inspections out of the way.

- Looking into insurance options.

- Finding a secure way to finance the mortgage.

If any of these isn’t agreeable to the buyer, he can simply drop the deal.

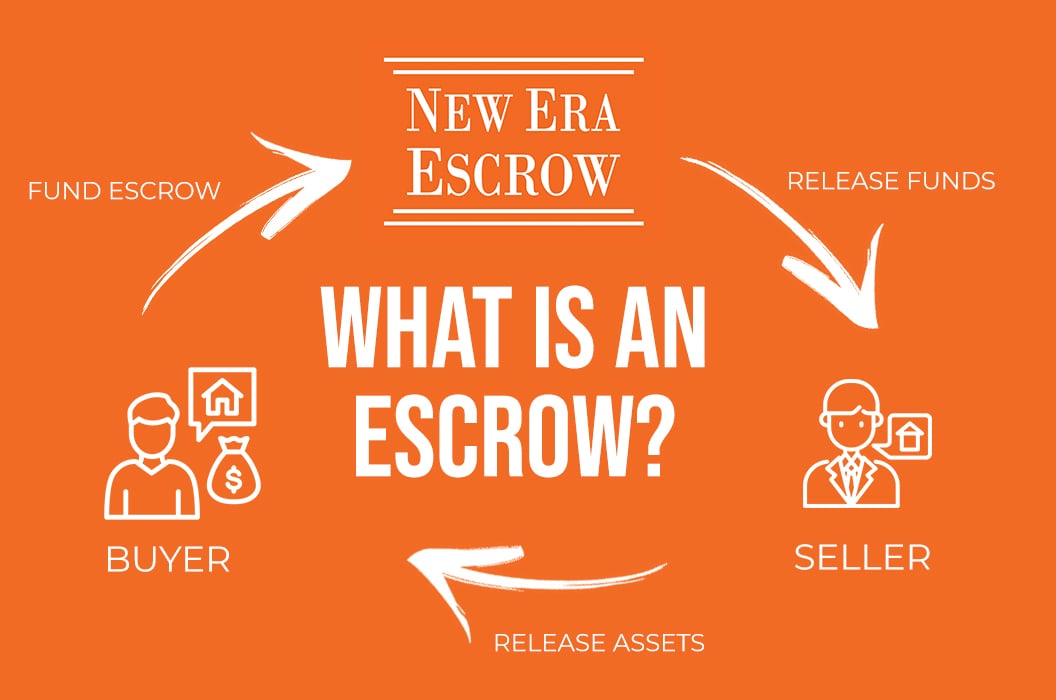

An escrow is when a real estate property falls into a temporary state of being legally on hold. The property cannot be released until the seller is able to meet specified conditions, especially in completing financial transactions. These transactions include mortgages, annual insurances, inspections, etc.

Fun fact: the term escrow is not used solely in real estate properties.

So there goes the importance of handling an escrow with precision and efficiency. But then the real question comes up: who exactly handles an escrow? What does a seller need to know about making this process bearable and guaranteeing that the sale is closed?

With that in mind, let’s look at the seven things you need to know about escrow that will make it more manageable for homeowners looking to sell their property.

How do mortgage escrows work?

After closing a sale, the buyer cannot just immediately get to move into his new home. This is just the start of the process. The sale must now go into a series of stages that need to be completed. These typical stages include the appraisal of the property value with the bank, who then approves or declines the asking price, home inspection, insurance, ensuring a clear title, repairs, etc.

Does someone take over the escrow process?

Shortly after both parties (the buyer and the seller) sign the purchase contract, an escrow account is opened to facilitate the escrow process. An escrow agent handles putting the money into the escrow account and managing the funds to meet the predetermined conditions set before the sale.

The escrow agent is a third-party individual who processes the transactions on behalf of the buyer and the seller to complete the stages mentioned above. This is why it’s important to find an escrow agent where you can entrust the transaction and hold the escrow funds and assets.

They are in charge of protecting both the buyer and the seller’s financial interests during the transaction to ensure that the funds are appropriately allocated and that the contract is followed.

What are the costs of an escrow account?

The amount you’re going to need for an escrow account depends on anticipated costs after closing the sale. These include property taxes, home insurance, and PMI.

The local government determines the tax value after assessing the property, while insurance payments will depend on your choice of coverage.

What are the benefits of an escrow account?

Homeowners, buyers, and lenders all benefit from opening an escrow account for a transaction. As a homeowner, it relieves you of having to pay insurance and taxes in one go. Due dates can be a pain, so having an escrow agent take over ensures bills are taken care of on time.

Buyers are protected from getting their deposit forfeited should they decide against the sale after the inspections. On the other hand, lenders are clear from foreclosure, and insurance coverage lapses as an escrow agent makes sure all of the payments are made.

Is it possible to opt-out of escrow?

Some lenders will offer leniency in escrow requirements when the buyer pays a 20% or higher down payment. However, since real estate negotiations and deals are often complicated with legal fees, interest rates, and other things to take into account, it is highly recommended that you find a trusted escrow agent.

How do you monitor your escrow account and/or balance?

A third-party entity or agent will manage your escrow account. That said, you can request portals to access your account online. In some cases, you will be advised to be in contact with your bank. The best way to know your options is to talk to your escrow agent or mortgage servicer.

Are you paying for interest in your escrow account?

You’re not. When you open an escrow account with a bank, they’re not charged any interest for the account. In other words, escrow accounts are not considered interest-bearing accounts. Similarly, your escrow account will not earn you any interest. This is why some homeowners prefer to close their escrow accounts and move their money to savings accounts.

Finding the Right Escrow Company

In handling finances, you’d only want to work with the most trustworthy people. Escrow companies may be reaching out to you left and right to offer their services, but there are a few things to keep in mind before making a choice.

Things to look for include experience and credibility, accountability, and reliability. Go with escrow agencies or companies with only the best in the industry- professionals who can ensure all conditions of your escrow instructions are met and provide only the best customer care you’ll find.

You can check their credibility quickly by looking for client testimonials. By doing this, you can easily see if the company possesses the accountability and reliability you should be looking for. Another option is to talk to the people in your community, ask for referrals, or read reviews online.

More often than not, escrow professionals who have been around for a long time may provide better services and advice. Since you’re in a transaction that’s far from being just a single straight line, you’ll want all the help you can get. If this help comes from a professional, you’ll have peace of mind.

The Takeaway

Real estate can be a tricky industry, especially for someone unarmed with the proper knowledge. It’s easy to get lost in the middle of the multidimensional transactions that are underway as soon as you and your buyer agree on a price.

The possibility of streamlining the process from when a deal is signed between you and your buyer can save you tons of time and money, not to mention having peace of mind as you take due dates off your list of worries.

On the other hand, if you’re on the buying end, an escrow will provide peace of mind in the form of protection for your deposit, your monthly payments for insurance, etc.

Segal, T. (2022, March 23). Understanding the Escrow Process and Requirements. Investopedia.

Dehan, A. (2022, June 15). Escrow: What Is It and How Does It Work?. Rocket Mortgage.

Musinski, B. (2020, June 24). Mortgage Escrow: What You Need to Know. Forbes Advisor.

Chen, J. (2021, March 25). In Escrow Status. Investopedia.

Denha, L. Duties of an Escrow Agent and Settling of Disputes Between Parties. Denha & Associates, PLLC.

Grace, M. (2022, February 27). Escrow Agent: What You Need to Know. Rocket Mortgage.

(2006, November 27). How Can I Avoid Escrows on My Mortgage? Mortgage Professor.

Graham, K. What is an Escrow Account? (2022, May 20). Definition and Facts. Quicken Loans.

Clemon, D. (2022, March 14). Do Mortgage Escrow Accounts Earn Interest? Investopedia.